Your Home Sold Guaranteed - J & S Group

Call or Text Today! 407-791-4713

Recent:

Many homeowners lookingto sellfeel like they’re stuck between a rock and a hard place right now. Today’smortgage ratesare higher than the one they currently have on their home, and that’s making it harder towant to selland make a move. Maybe you’re in the same boat.

But what if there was a way to offset these higherborrowing costs? There is. And the money you need probably already exists in your current home in the form of equity.

Think of equity as a simple math equation.Freddie Macexplains:

“. . . your home’s equity is the difference between how much your home is worth and how much you owe on your mortgage.”

Your equity grows as you pay down your loan over time and as home prices climb. And thanks to the rapid homeprice appreciationwe saw in recent years, you probably have a whole lot more of it than you realize.

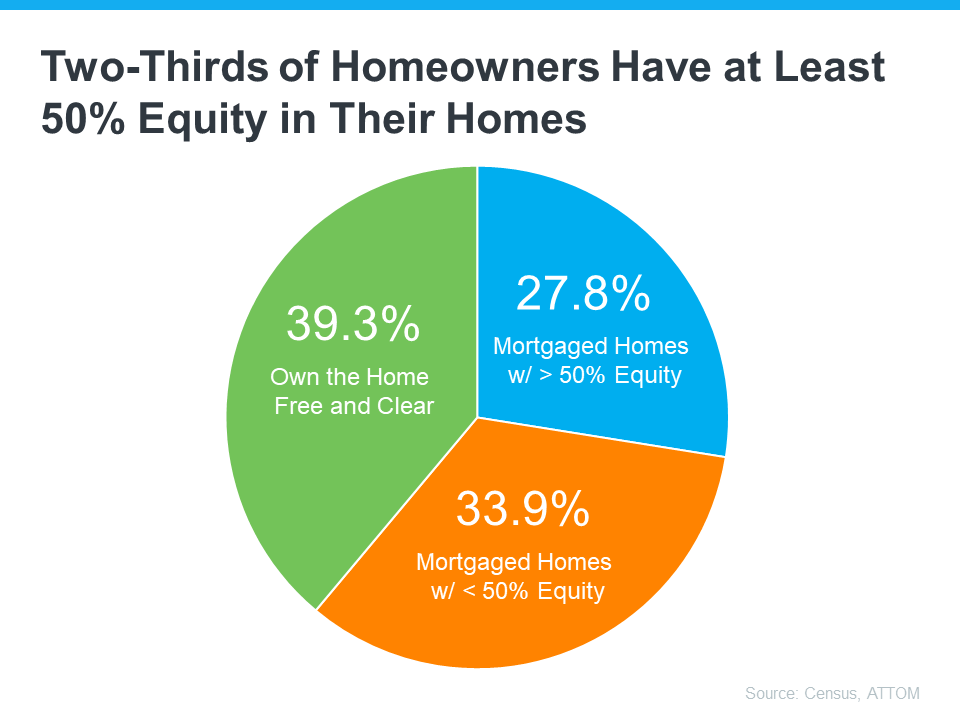

The latest from theCensusandATTOMshows more than two out of three homeowners have either completely paid off their mortgages (shown ingreen in the chart below) or have at least 50% equity (shown inblue in the chart below):

That means the majority of homeowners have a game-changing amount of equity right now.

After yousellyour house, thatequitycanhelp you move without worrying as much about today’s mortgage rates. As Danielle Hale, Chief Economist forRealtor.comsays:

“A consideration today's homeowners should review is what their home equity picture looks like.With the typical home listing price up 40% from just five years ago, many home sellers are sitting on a healthy equity cushion.This means they are likely to walk away from a home sale with proceeds that they can use to offset the amount of borrowing needed for their next home purchase.”

To give you some examples, here are a few ways you can useequityto buy your next home:

Want to find out how much equity you have? To do that, you’ll need two things:

You can probably find the mortgage balance on your monthly mortgage statement. To understand the current market value of your house, you can pay hundreds of dollars for an appraisal, or you can contact a localreal estate agentwho will be able to present to you,at no charge, a professional equity assessment report (PEAR).

Once you’ve connected with a trusted local agent and run the numbers, you’re one step closer to making a move you may not have thought was realistic – all thanks to your equity.

If you want to find out how much equity you have and talk more about how it can make your next move possible, let’s connect.

6-7-2024

CATEGORIES: equity, for sellers, selling tips